The American Institute of Certified Public Accountants is the largest trade organization for professional accountants. Founded in 1887, the AICPA holds more than 430,000 memberships with accountants that come from more than 145 countries around the world.

There are different membership levels in AICPA, but regular membership calls for successfully completing the requirements for a certified public accountant or CPA designation.

To qualify for individual membership, you should have held or currently hold a CPA license, passed the CPA licensure examination, and completed 120 hours of continuing professional education credits. Associate membership is open to those who have passed the CPA exam but who have not met the requirements for licensure or designation.

International associate memberships are reserved for those who have earned their CPA designation from non-U.S. accounting associations recognized by AICPA. Other types of membership include non-CPA affiliate, CPA exam candidate affiliate, and student affiliate. AICPA members hold positions in the government, educational institutions, public corporations, or nonprofit organizations. They may also be in private practice.

The AICPA performs specific functions for the advancement of its members and the practice of management accounting. This article will discuss five of the most critical functions performed by the AICPA, discussing why the AICPA exists, and the kind of purpose it serves in a real-world application.

If you have ever been curious about becoming an accountant, knowing what the AICPA does can be an invaluable resource to helping you on your accounting journey.

See also: The Best Online Colleges for Accounting

What Does the AICPA Actually Do?

| Sets ethics and best practices standards |

| Develops credentialing programs |

| Leads and sponsors advocacies |

| Undertakes research |

| Publishes helpful information |

Table of Contents

1. Setting Standards of Ethics and Best Practice for Accounting Professionals

AICPA guidelines define generally accepted accounting standards for various areas of practice for CPAs. Despite recent developments that transferred some of the oversight for CPA practices in public companies, AICPA retains considerable influence in setting standards, enforcing ethical practices, and monitoring service quality concerning accepted accounting practices for CPAs in private practice or who provide services to individuals and privately held companies.

Under the helm of the Securities and Exchange Commission, the Financial Accounting Standards Board establishes and authorizes accounting rules, and AICPA provides technical and administrative support as needed.

As with many other professions in the world, being an accountant requires serving the public, interacting closely with your clients, and dealing with their finances. That being said, there are many different ethical standards that need to be upheld in order for your clients to be treated with respect and transparency. For this reason, the AICPA has developed its own Professional Ethics Executive Committee, which enforces the AICPA Code of Professional Conduct.

For these ethics standards to be appropriately upheld, this committee investigates any potential disciplinary action involving AICPA members, presents evidence of potential code infractions in front of a jury, and interprets the code itself as well as poses any possible amendments to that code. This committee is composed of 21 AICPA members who are appointed by the Board of Directors every year.

2. Developing Credentialing Programs to Enhance Member Competencies

CPE credits are mandatory for those renewing their CPA license and AICPA membership as well. AICPA offers seminars and training programs that count as CPA credits. These programs may be single-unit events or an entire course that will lead to a new credential for the member.

The AICPA has an entire section on its website dedicated to these credentialing programs and certifications. For those looking to become a CPA, the AICPA offers resources on taking your exam and getting your official license.

For more short-term credentialing, the AICPA offers coursework on topics like a Personal Financial Specialist credential, a Certified Information Technology Professional credential, or a certification in Financial Forensics.

Longer, more intensive certificate programs from the AICPA include technology, accounting and auditing, tax advisory services, risk management, and internal control.

The Personal Financial Specialist credential is for CPAs specializing in personal financial planning services. The Certified Information Technology Professional is a CPA specializing in the intersection of technology and accounting practices, while CPAs taking the Accredited in Business Valuation program learn about valuation and forensic litigation strategies that could help clients maximize the yield of their investments.

3. Leading and Sponsoring Advocacies that Benefit Accounting Professionals

AICPA monitors legislative efforts and other issues that may have an impact on accounting practices and standards. In addition, AICPA collaborates with state CPA societies and other organizations to disseminate information and educate federal, state, and local policymakers on accounting sector issues.

Finally, although every US state has its own governing body regarding accountancy, the AICPA is responsible for setting national accounting standards. Thus, the AICPA essentially streamlines the difficulty of understanding accounting standards state-by-state.

The AICPA may also prepare comment letters on technical proposals and contribute professional feedback for legislative initiatives directly affecting the accounting profession.

4. Undertaking Research

Legislation and ethics requirements are constantly being updated in the world of accounting. It takes a lot of internal knowledge of the accounting industry in order to understand new laws fully, and the AICPA does a lot of this work for you. The AICPA is constantly updating its database of research as well as conducting its own research on budding laws to keep its members up-to-date.

AICPA prepares white papers and technical briefs on pending and approved legislation. The organization may also create guidelines for compliance with new legislation while encouraging feedback on specific features of initiatives and programs that relate to the practice of accounting.

The AICPA aims for none of their members to be left in the dark when it comes to new industry compliances, and keeping up to date with AICPA publishings is one way to ensure you stay in the loop.

5. Preparing and Curating Publications on Industry-related Matters

Aside from its regular newsletters, AICPA maintains a library of resources that members can access for free or at discounted prices. These publications include books, journals, and other trade publications covering topics such as accounting and auditing, business valuation, financial management and reporting, fraud and forensic strategies, practice management, and financial planning.

Having your own personal learning goals is absolutely vital to your growth as an accounting professional, but obtaining new resources can be difficult for those who don’t have access to things like university databases or major libraries. However, becoming a member of the AICPA solves that problem entirely by providing licensed accountants with the information they need to succeed.

The American Institute of Certified Public Accountants plays a crucial role in ensuring that accounting professionals are held to the highest standards. To ensure member success in all aspects, AICPA provides resources to help members gain more credentials and master the skills to help them succeed.

In addition, AICPA takes a leadership role in advocacies and research initiatives that benefit accounting professionals.

Why Is The AICPA So Necessary For Accountants?

The AICPA isn’t required to become an accountant, but the people who do choose to become members of the AICPA are certainly better accountants for it. Of course, some might argue that you don’t actually need to be a member of the AICPA to have a successful career as an accountant. Still, the reality is that an AICPA membership will likely make your journey to become a CPA much easier. Not only does the AICPA offer resources for those attempting to pass their CPA exam, but they also have countless books, papers, and studies available to those who are already registered CPAs.

The AICPA is also a vital resource for understanding accounting ethics and industry standards, as previously mentioned. It might be difficult for you to decode your state’s individual practices for accountants, but the AICPA provides you with the national standards you will need to uphold as a CPA. Approximately 35-percent of the AICPA’s membership is women, so it is also an invaluable resource for female CPAs working in an industry primarily dominated by men.

What Is The Primary Role of a CPA?

Essentially, a CPA is a more qualified and certified accountant. Every single CPA is an accountant, but not every single accountant is a CPA. Obtaining certification as a CPA essentially requires more experience, more opportunity, and further study. Having a CPA credential is essentially just an additional stamp of trustworthiness and expertise in the accounting world.

A CPA could be a CFO at a major company or operate their own firm in a small neighborhood. A CPA, also known as a certified public accountant, helps individuals, businesses, or nonprofits manage their finances and achieve their financial goals. This can be through planning and executing the opening or merger of a new company, buying a new home or office, or handling investments like stocks.

Pretty much any business, individual, or organization requires the help of a CPA at some point, so job opportunities exist all across the board. Whether you want to work for a small start-up, open your own small-town firm, or help a celebrity manage their money, there is undoubtedly a job available for you as a CPA.

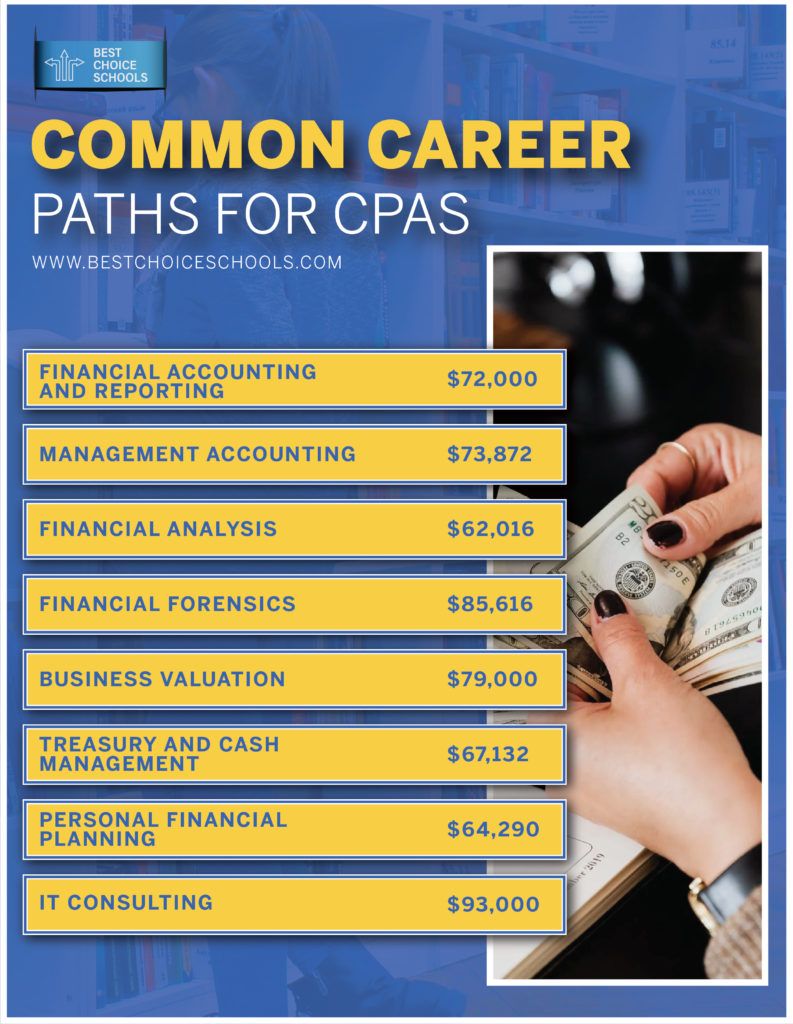

Common Career Paths for CPAs

How Much Do CPAs Make?

As we mentioned previously, CPAs are in incredibly high demand across the financial industry because pretty much every organization needs one. Therefore, the salary of a CPA is highly competitive and can vary depending on the kind of organization you work for. For example, the average salary for a CPA in the US is around $40,000 to $65,000 for an entry-level employee, while more senior CPAs can make between $66,000 and $110,000 a year.

The kind of money you make as a CPA will also depend on the firm you work for. Whether you work in a small firm or large firm will significantly impact your salary, usually, those who work in larger firms make considerably more money.

Those who are managers and directors at major firms often also make a much higher salary, as they are a veteran in the industry with seven or more years of experience. Managers or directors can earn upwards of $150,000 a year with virtually no salary cap.

Some states in the US have a much higher average salary for CPAs than others, with states like New York, California, Massachusetts, New Jersey, Texas, and Washington having an average of between $78,970 and $98,130 salary for CPAs in 2018.

The kind of money you make as a CPA is really dependent on things like the company you work for, your organization or firm’s location, and your seniority in the field.

What Kinds of Accounting Jobs Exist On The Market?

Accountants do a lot more than just your taxes. Depending on the company you work for, you might be dealing with corporate finance, business services, auditing, forensics, funds management, or taxes. If you work for a Fortune 500 company, you might also eventually be able to work as the bookkeeper or even the company’s CFO.

While it might seem like accounting or becoming a CPA is a pretty narrow career path, there are actually a variety of different things you can do. And, as we previously mentioned, virtually any entity needs to employ some kind of accountant to keep their finances in order. If you like a company and enjoy its mission and goals, that accountant could be you!

Should I Become An AICPA Member?

AICPA membership is not required to become a registered CPA. However, it is notoriously difficult to become a CPA, and this undertaking should not be done lightly. With the help of an AICPA membership, you will have access to more course materials, more legal resources, and a massive network of people pursuing the same goals as you.

Additionally, if you are already a CPA, becoming a member of the AICPA can help you advance your career with new certifications and credentials.

The best way to take advantage of an AICPA membership is to see whether or not the firm you work for will pay for it. If you aren’t even paying your own membership, you truly have nothing to lose by becoming an AICPA member.

You might also like:

5 Great Scholarships for Accounting

What are the Prerequisites for a Master’s in Accounting?

What Is the Employment Outlook for the Accounting Profession?